TDS on Purchase of Property where Buyer and Seller both are Resident in India

1. About The TDS

The Indian government has introduced Tax Deducted at Source (TDS) on the purchase of immovable property to ensure tax compliance and curb tax evasion. If a buyer purchases a property (excluding agricultural land)(frm Builder or in Resale) worth ₹50 lakh or more, they are required to deduct 1% of the total sale value as TDS and deposit it with the government. This responsibility lies with the buyer, not the seller. The deducted amount must be submitted using Form 26QB within 30 days from the end of the month in which the deduction was made. Failure to comply can result in interest, late fees, and legal consequences. This provision promotes transparency in real estate transactions, ensuring that tax liabilities are duly met and unaccounted money is minimized in property dealings.

2. TDS on Property Purchase

TDS on the Purchase of property is governed by Section 194IA of the Income Tax Act, 1961 to ensure tax compliance and prevent tax evasion in real estate transactions. As per this section, if a buyer purchases an immovable property (excluding agricultural land) worth ₹50 lakh or more, they must deduct 1% TDS from the total sale consideration before making the payment to the seller. The deducted amount must be deposited with the Income Tax Department using Form 26QB within 30 days from the end of the month in which the TDS is deducted. If the payment is made in instalments, TDS must be deducted from each instalment and deposited with Income Tax Department. The seller must also provide their PAN, as failure to do so may increase the TDS rate to 20%. Non-compliance with this provision can lead to interest, penalties, and legal consequences. This section ensures transparency in high-value property transactions, reducing the risk of unaccounted money in real estate.

Example: Property Purchase Above ₹50 LakhImagine Amit buys a flat from Rahul for ₹75 lakh. According to Section 194IA, Amit must deduct 1% of ₹75 lakh (i.e., ₹75,000) as TDS before making the payment to Rahul. Amit will then deposit ₹75,000 with the Income Tax Department using Form 26QB within 30 days from the month of deduction. The remaining ₹74,25,000 will be paid to Rahul.

3. When Does TDS Apply to Property Deals?

TDS on property transactions applies when a buyer purchases an immovable property (excluding agricultural land) worth ₹50 lakh or more. The buyer must deduct 1% of the total sale amount before paying the seller and deposit it with the Income Tax Department. This rule covers residential properties, commercial properties, and land purchases to ensure tax compliance in real estate.

Example: Apartment Purchase Above ₹50 Lakh

Rahul buys a flat from Priya for ₹70 lakh. As per Section 194IA, Rahul must deduct 1% of ₹70 lakh (i.e., ₹70,000) before transferring the payment. He deposits ₹70,000 as TDS and pays ₹69,30,000 to Priya.

4. TDS Rate on Property Sales

The TDS rate on property sales is 1% of the total sale value if the property price is ₹50 lakh or more. This deduction is made by the buyer before paying the seller and must be deposited with the Income Tax Department. However, if the seller does not provide a PAN, the TDS rate shoots up to 20%, making compliance essential. This rate of TDS shall not apply to Property purchased from NRI (TDS on Property purchased from NRI).

Example 1: Standard rate of TDS Deduction

Arjun buys a house from Rohit for ₹80 lakh. He must deduct 1% of ₹80 lakh (₹80,000) and deposit it with the government before paying the remaining ₹79,20,000 to Rohit.

Example 2: Higher rate of TDS Due to Missing PAN

If Arjun buys a house from Rohit for ₹80 lakh but Rohit does not provide his PAN, the TDS rate rises to 20%. Now, Arjun must deduct ₹16 lakh (20% of ₹80 lakh) instead of just ₹80,000, significantly reducing Rohit’s final payment.

5. Exemptions from TDS

Not every property sale falls under the purview of TDS regulations, as the government has provided certain exemptions to ease the burden on buyers and sellers.

a) If the property value is below ₹50 lakh, there is no requirement to deduct TDS, regardless of whether the property is a residential house, commercial property, or vacant land. This exemption helps buyers of lower-value properties avoid additional tax deductions and compliance requirements.

b) Agricultural land enjoys a complete exemption from TDS, irrespective of its value. Whether the land is being sold for ₹10 lakh or ₹10 crore, if it qualifies as agricultural land under income tax laws, the buyer is not obligated to deduct TDS. However, the land must meet specific criteria such as being located outside municipal limits or used for agricultural purposes to be considered exempt.

c) Where a property is inherited or received as a gift, TDS does not apply, since no direct sale transaction takes place.

d) If multiple buyers purchase a property and each individual's share is valued below 50 Lakh, but only if the sale agreement specifies the individual shares less than ₹50 lakh, TDS may not be required.

These exemptions ensure that small property transactions, rural land deals, and non-commercial exchanges do not fall under unnecessary tax deductions, keeping compliance simpler for buyers and sellers while maintaining fairness in taxation.

6. How to Deduct and Deposit TDS on Property Transactions

The process of deducting and depositing TDS on property sales is straightforward but must be followed carefully to avoid penalties. When a buyer purchases a property worth ₹50 lakh or more, they must deduct 1% TDS from the total sale value before making the payment to the seller. The deducted amount must then be deposited with the Income Tax Department within 30 days using Form 26QB.

Step-by-Step Process:

- Deduct TDS – Before transferring the payment, deduct 1% of the sale value and inform the seller.

- Visit the Tax Payment Portal – Go to the TIN NSDL website (https://www.protean-tinpan.com/) and select e-Payment of TDS (Form 26QB).

- Fill Form 26QB – Enter details like buyer and seller PAN, property value, TDS amount, and payment mode.

- Make the Payment – Pay the TDS amount online via net banking, debit card, or challan at an authorized bank.

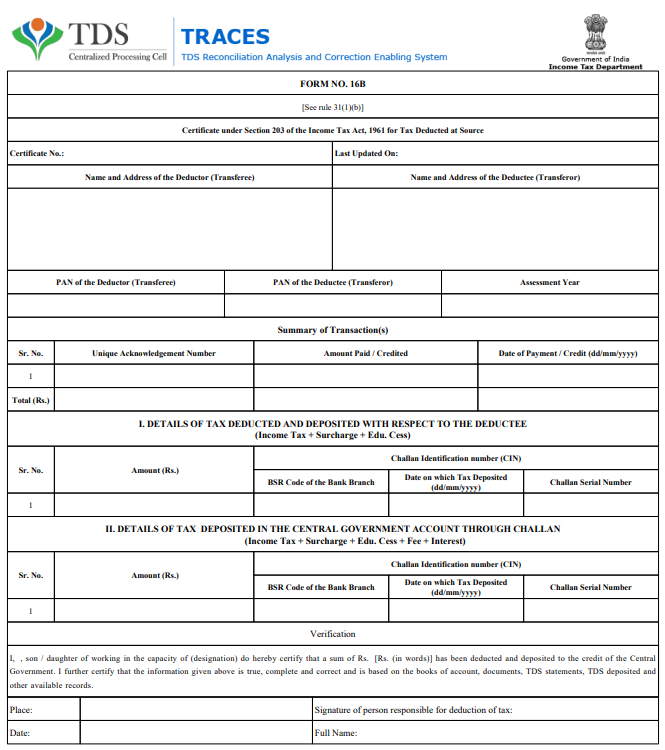

- Generate TDS Certificate (Form 16B) – After payment, download Form 16B from the TRACES portal and provide it to the seller as proof of deduction.

Example:

Rahul buys a house from Meera for ₹80 lakh. Before paying Meera, he deducts ₹80,000 (1% TDS) and deposits it through Form 26QB within 30 days. He then provides Form 16B to Meera as confirmation of the TDS deduction.

Failure to deduct or deposit TDS on time can lead to interest, penalties, and legal consequences, making it essential for buyers to follow these steps diligently.

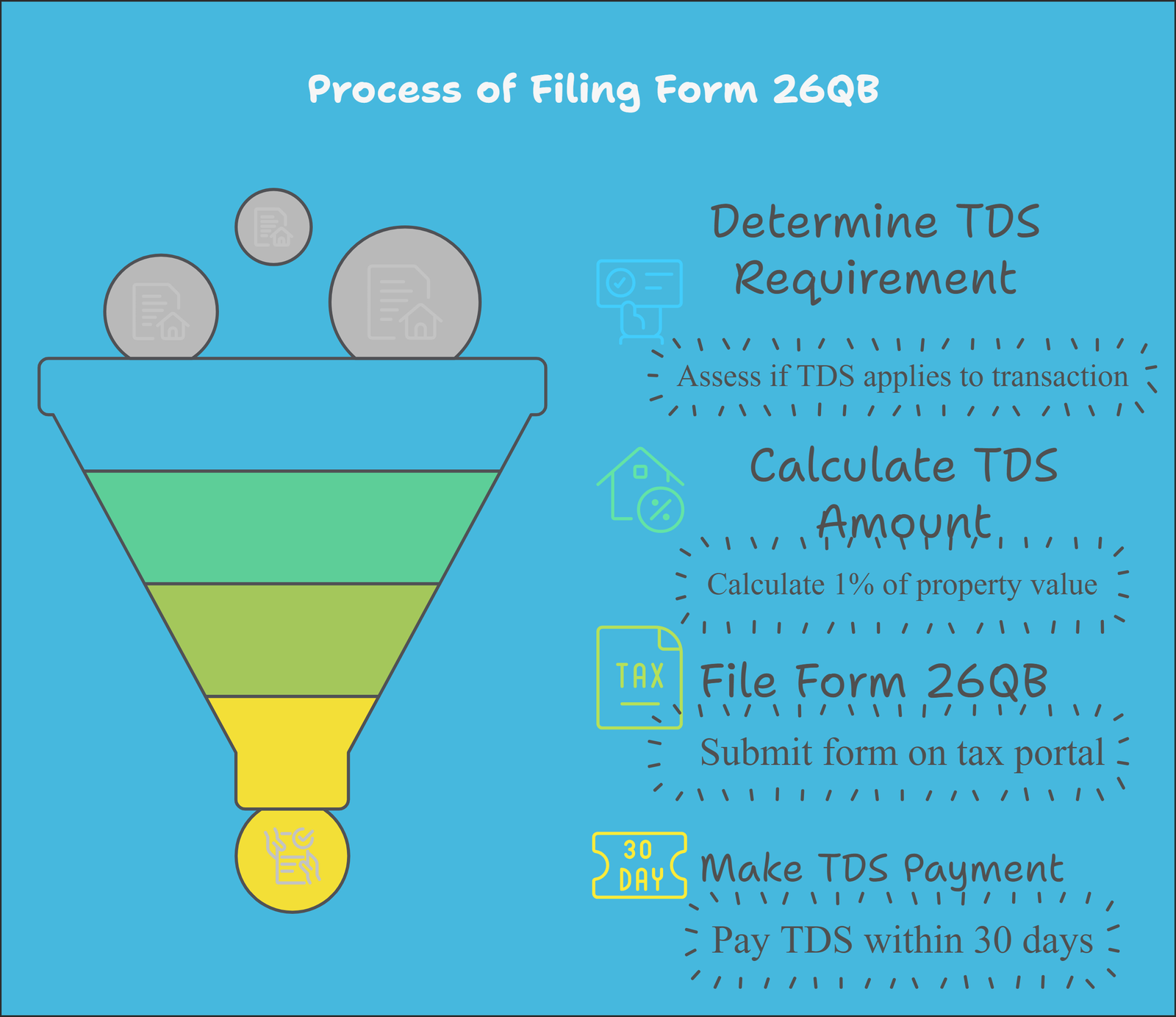

7. Process of Filing Form 26QB for TDS on Property

Form 26QB is a mandatory online form used to deposit TDS on property transactions under Section 194IA of the Income Tax Act. The buyer must file this form when purchasing a property worth ₹50 lakh or more and deposit 1% TDS within 30 days from the end of the month in which the payment was made.

Step-by-Step Guide to Filing Form 26QB

Visit the Official Tax Portal

- Go to the Protean-TIN (NSDL) website: https://www.protean-tinpan.com/

- Click on e-Payment of TDS on Property (Form 26QB) under the TDS on Sale of Property section.

- Fill in Buyer and Seller Details

- Enter PAN details of both buyer and seller (PAN validation will be done).

- Mention full name, contact details, and address for both parties.

Provide Property and Payment Details

- Enter property details, including type (residential/commercial/land) and address.

- Mention the total sale consideration and TDS amount (1% of property value).

- Select the payment mode (net banking or challan payment at a bank).

Make the Payment

- If using net banking, complete the payment online and download the Challan 280 receipt.

- If paying via bank challan, take a printout and visit an authorized bank to deposit the TDS.

Generate and Download Form 16B

- After payment, wait for 7-10 days, then log in to the TRACES portal (https://www.tdscpc.gov.in/).

- Download Form 16B (TDS Certificate) and provide it to the seller as proof of deduction.

Form 16B (TDS Certificate)

Example:

Ravi buys an apartment from Ankit for ₹75 lakh. Before making the payment, Ravi deducts ₹75,000 (1% TDS) and fills Form 26QB online. He pays the TDS through net banking and later downloads Form 16B from TRACES to give to Ankit.

Important Things to Keep in Mind

- If you're buying a property worth more than ₹50 lakh, filing Form 26QB is a must.

- You need to deposit the TDS within 30 days, or you might face penalties.

- Make sure both your PAN and the seller’s PAN are correct, or it could cause tax credit issues later.

- After paying TDS, download Form 16B and give it to the seller as proof that you've deducted and deposited the tax.

Filing Form 26QB correctly ensures tax compliance and avoids penalties, making real estate transactions smooth and legally sound.

8. Penalties for Not Following TDS Rules on Property Transactions

When buying a property worth more than ₹50 lakh, it’s not just about making payments to the seller; the buyer has a legal responsibility to deduct Tax Deducted at Source (TDS) and deposit it with the Income Tax Department. If this process is not followed correctly, the buyer may face heavy penalties, interest charges, and fines. The government enforces these penalties to ensure tax compliance and curb tax evasion in real estate transactions. Here’s a detailed breakdown of what happens when TDS is not deducted or deposited on time.

1. Interest for Late Deduction or Payment

When a property transaction is made, the buyer must deduct 1% TDS from the total sale amount before transferring the payment to the seller. If the buyer forgets or fails to deduct TDS, they will be charged an interest of 1% per month on the TDS amount. This interest is calculated from the date the TDS should have been deducted until the date it is actually deducted.

Similarly, if the buyer deducts the TDS but does not deposit it with the Income Tax Department, the penalty is even higher. In this case, the government imposes an interest of 1.5% per month from the date of deduction until the TDS is finally deposited. This higher rate ensures that buyers do not hold back tax payments that are meant to go to the government.

Example:

Amit purchases a house from Suresh for ₹80 lakh but forgets to deduct the 1% TDS (₹80,000). After 5 months, he realizes the mistake and finally deducts the TDS. Since the deduction was delayed by 5 months, Amit must pay ₹4,000 (1% of ₹80,000 for 5 months) as an interest penalty.

Now, if Amit further delays depositing the TDS to the government for another 3 months, he will have to pay an additional ₹3,600 (1.5% of ₹80,000 for 3 months) as interest on late payment.

This means Amit, instead of just paying ₹80,000 as TDS, now has to pay an extra ₹7,600 as interest, simply because of the delay.

2. Late Fee for Delayed Form 26QB Filing

Once the buyer deducts TDS, they must file Form 26QB and submit it to the Income Tax Department within 30 days of making the payment to the seller. This form is important because it acts as an official declaration that the TDS has been deducted and deposited correctly. If the buyer fails to file Form 26QB within the deadline, they are charged a late fee of ₹200 per day until the form is filed.

While there is no upper limit on the number of days for which this late fee can be charged, the total late fee cannot exceed the TDS amount. This means that if the TDS payable was ₹80,000, the late filing penalty cannot go beyond ₹80,000, but the buyer will still be burdened with a significant additional cost.

Example:

Meera buys a flat for ₹75 lakh and deducts ₹75,000 (1% TDS) but forgets to file Form 26QB for 100 days. She will be charged a late fee of ₹200 × 100 = ₹20,000 just for the delay in filing. If she had delayed filing for 500 days, the fee would be ₹1,00,000, but since it cannot exceed the TDS amount, it would be capped at ₹75,000.

Even though Meera has paid the TDS amount correctly, just failing to submit Form 26QB on time results in a hefty penalty, making timely compliance extremely important.

3. Penalty for Non-Payment of TDS

The most serious penalty is when the buyer completely fails to deduct TDS or deducts it but never deposits it with the government. If a buyer does not deduct TDS at all, the Income Tax Officer has the power to impose a penalty equal to the TDS amount. This means that the buyer will have to pay the entire TDS amount from their own pocket, in addition to any interest or late fees.

If the buyer deducts TDS but does not deposit it, the situation becomes even worse. Not only will the buyer have to pay the TDS amount and interest, but they could also face a penalty ranging from ₹10,000 to ₹1,00,000, depending on the severity of the delay. In some cases, if the non-payment is intentional, the tax authorities may even initiate legal proceedings.

Example:

Ravi buys a commercial shop for ₹90 lakh but does not deduct ₹90,000 (1% TDS) before making the payment to the seller. After a tax audit, the Income Tax Department finds this non-compliance and issues a penalty equal to the TDS amount—meaning Ravi now has to pay ₹90,000 from his own funds, in addition to any interest charges.

If Ravi had deducted the TDS but failed to deposit it for a long period, he could face additional penalties ranging from ₹10,000 to ₹1,00,000, which would significantly increase his financial burden.

Ignoring or delaying TDS payments can quickly turn into a costly mistake, and the buyer could end up paying double or triple the original TDS amount due to penalties and interest charges

9. Refund of Excess TDS Deducted on Property Transactions

Sometimes, buyers mistakenly deduct more TDS than required when purchasing a property. This could happen due to calculation errors, multiple payments, or misinterpretation of tax rules. In such cases, the Income Tax Department allows the buyer to claim a refund for the excess TDS deducted and deposited. However, getting a refund is not an automatic process—it requires proper filing and following the prescribed procedure.

1. When can a TDS Refund Be Claimed?

A refund for excess TDS deducted on a property can be claimed in the following situations:

- Mistaken Overpayment: If the buyer deducted more than 1% TDS by error.

- Cancellation of Property Deal: If the transaction is cancelled after TDS has already been deducted and deposited.

- Double Payment: If the buyer deposits TDS twice for the same payment.

- Incorrect Property Value Consideration: If TDS was deducted based on a higher purchase price than what was actually paid.

2. How to Claim a TDS Refund?

Step 1: Check Form 26AS for TDS Details

Before applying for a refund, the buyer should check Form 26AS (available on the Income Tax e-filing portal) to ensure that the excess TDS amount is reflected in their tax records.

Step 2: File an Online Refund Request

The buyer (not the seller) must initiate the refund request through the TRACES (TDS Reconciliation Analysis and Correction Enabling System) portal. The process is as follows:

- Log in to the TRACES portal (https://www.tdscpc.gov.in).

- Go to ‘Refund Request’ under the Statements / Payments section.

- Enter the Assessment Year (AY) and Challan details of the excess TDS paid.

- Submit the refund request with supporting documents.

Step 3: Submit Supporting Documents

The buyer may need to provide documents such as:

- Proof of property transaction cancellation (if applicable).

- Sale agreement and payment receipts.

- PAN details of both buyer and seller.

- Form 26QB acknowledgement number.

Step 4: Income Tax Department Processing

Once submitted, the refund request is reviewed by the Assessing Officer (AO). If the documents are correct and verified, the refund is processed, and the excess amount is credited to the buyer’s bank account.

3. How Long Does the Refund Process Take?

The refund process typically takes 3 to 6 months, depending on the correctness of the documents and the verification process by the tax authorities. The buyer can track the refund status on the TRACES portal or the Income Tax e-filing website.

4. Example of Excess TDS Refund Claim

Example 1: Overpayment of TDS

Rahul buys an apartment worth ₹80 lakh. Instead of deducting 1% TDS (₹80,000), he mistakenly deducts ₹1,60,000 (2%) due to a calculation error. He deposits this excess amount with the Income Tax Department. After realizing the mistake, Rahul applies for a refund of ₹80,000 by submitting a request through TRACES. After verification, the refund is approved, and the excess amount is credited back to his account.

Example 2: Cancellation of Property Deal

Priya booked a property for ₹1 crore and deducted ₹1 lakh TDS before making the payment. However, due to legal issues, the deal was cancelled. Since the seller did not receive the payment, Priya was eligible for a full refund of the TDS amount. She filed a refund request along with the cancellation agreement, and after verification, the ₹1 lakh was refunded to her account.

Claiming a TDS refund requires patience and proper documentation, but following the correct procedure ensures that buyers recover their excess payments without financial loss.

10. What Happens When One Buyer Purchases a Jointly Owned Property?

In some cases, a single buyer may purchase a property that has multiple sellers. This situation has specific TDS implications:

- TDS Deduction for Each Seller

- · The buyer is required to deduct TDS separately for each seller’s share in the transaction.

- This means if there are two sellers, the buyer must ensure TDS is deducted from both portions individually.

- PAN Requirement for Sellers

- Each seller must provide their Permanent Account Number (PAN) to the buyer.

- The PAN ensures that the deducted TDS is credited correctly to the seller’s tax records.

- Higher TDS Rate if PAN is Missing If any seller fails to provide their PAN, the TDS rate increases from 1% to 20%.

- This can lead to a significant financial burden for the seller, making it crucial to ensure all PAN details are available.

· Joint Ownership – Who is Responsible for Deducting TDS?

When two or more buyers purchase a property together, they must all comply with TDS regulations:

- Each Buyer Must Deduct TDS Individually

- If two buyers are purchasing a property together, they must each deduct TDS for their respective share of the purchase price.

- The responsibility is shared, and each buyer must complete the TDS deduction separately.

- TDS Deduction Proportion

- The deduction remains 1% of the total sale value but is proportionally split among the buyers based on their share in the property.

- For example, if two buyers own the property equally (50%-50%), each must deduct 0.5% TDS on their portion.

- Avoiding Errors in Tax Filing

- Since multiple buyers are involved, proper coordination is needed to avoid errors while filing TDS returns.

- Any mistake can lead to penalties or issues in tax credit claims for the sellers.

· TDS Deduction on Loan-Financed Property

Most property transactions are financed through home loans, and many buyers assume that the bank will handle the TDS deduction. However, that’s not the case:

- TDS Deduction on Buyer’s Contribution

- TDS must be deducted from the portion of the property payment made directly by the buyer.

- This includes the down payment or any other amount paid before the loan is disbursed.

- Banks Do Not Deduct TDS

- Financial institutions such as banks do not deduct TDS when releasing loan payments.

- The responsibility falls entirely on the buyer to ensure compliance.

- Timely Deduction to Avoid Penalties

- Buyers should deduct TDS at the time of making payments to the seller.

- Failure to do so can result in penalties and additional interest charges.

· How to Ensure Smooth TDS Compliance?

To avoid complications and penalties, buyers and sellers should follow these steps:

- Clarify Ownership Structure

- Before finalizing the sale, all parties should clearly define the ownership percentage in the sale agreement.

- This helps determine the exact TDS deduction required from each buyer and for each seller.

- Ensure All PAN Details Are Updated

- Both buyers and sellers should ensure that their PAN details are correct and updated with the Income Tax Department.

- Any mismatch can cause delays or incorrect tax credits.

- File Forms 26QB and 16B on Time

- Buyers must fill out Form 26QB, which is the TDS payment form, to ensure proper tax submission.

- Sellers should receive Form 16B, which serves as proof of TDS deduction.

- Delays in filing these forms can lead to fines and other tax complications.

11. Buying One Property in Joint Name – Understanding Joint Ownership and TDS

When purchasing a property with multiple buyers, tax obligations change slightly. Each buyer is responsible for their own share of Tax Deducted at Source (TDS). Many people assume that only one person needs to handle TDS, but that’s not the case. Here’s a clear breakdown of how TDS works in joint property ownership and what buyers need to keep in mind.

· Who Deducts TDS in Joint Ownership?

If a property is bought by more than one person, the responsibility for deducting TDS is divided among the buyers. Here’s what you need to know:

- TDS Deduction as Per Ownership Share

- Each buyer must deduct TDS based on their share in the property.

- For example, if two buyers purchase a house and own it equally (50%-50%), each is responsible for half of the TDS deduction.

- Separate TDS Deposits for Each Buyer

- The deducted TDS amount must be deposited separately for each buyer.

- This means if there are two buyers, they cannot combine the TDS amount into one deposit—each person must deposit their respective share individually.

- Filing Form 26QB for Each Buyer

- Form 26QB is a mandatory online form used to report TDS deducted on property purchases.

- Since each buyer is deducting TDS separately, they must each file Form 26QB individually.

- This ensures proper tax credit to the seller and helps avoid any future tax complications.

· How is TDS Calculated in Joint Ownership?

TDS on property transactions is calculated at 1% of the total sale value if the property price exceeds ₹50 lakhs. However, in joint ownership, this calculation is split among buyers.

Let’s take an example:

- Suppose two buyers purchase a property worth ₹80 lakhs with an equal ownership share of 50%-50%.

- The ₹50 lakh threshold still applies to the total property value, meaning TDS is applicable.

- TDS at 1% on ₹80 lakhs = ₹80,000.

- Since both buyers share ownership equally:

- Each buyer must deduct and deposit ₹40,000 separately (₹80,000 ÷ 2).

- They must also file their individual Form 26QB to report this deduction.

This method ensures that the seller receives the correct tax credit and that the buyers stay compliant with tax regulations.

· What Happens if One Buyer Fails to Deduct TDS?

If one of the buyers does not deduct or deposit their share of TDS, it can lead to several complications:

1. Penalties and Interest for Non-Compliance

- The buyer who fails to deduct or deposit TDS on time will be liable for penalties.

- The tax department may charge interest on the unpaid TDS amount, increasing the financial burden.

- If the delay continues, further legal consequences may follow.

2. Impact on the Seller’s Tax Credit

- The seller depends on the buyer’s TDS deduction to claim tax credit in Form 26AS (a tax credit statement).

- If TDS is not deducted correctly by all buyers, the seller may not receive full credit, leading to disputes and potential tax liabilities for them.

- Difficulties in Property Transactions

- If TDS is not properly deposited, it may cause issues when registering the property or during future tax audits.

- In extreme cases, it may even delay or complicate the property transfer process.

12. Correction of Form 26QB – What You Need to Know

Form 26QB is a crucial document used for reporting Tax Deducted at Source (TDS) on property transactions. If any mistake is made while filling out this form, it needs to be corrected to avoid tax complications for both the buyer and the seller. Many people don’t realize that errors in this form can lead to issues like incorrect tax credits, penalties, and delays in property registration.

Below is a detailed breakdown of how to correct mistakes in Form 26QB and what to keep in mind.

· What Are Common Mistakes in Form 26QB?

Filin Form 26QB requires attention to detail. Here are some of the most common errors buyers make:

Incorrect PAN Details

- If the buyer or seller’s PAN (Permanent Account Number) is entered incorrectly, it can lead to tax credit mismatches.

- The seller may not get the correct tax credit in Form 26AS, causing unnecessary tax disputes.

Wrong Property Details

- Errors in property address, transaction value, or ownership share can create confusion during tax verification.

- The tax department uses this form to verify real estate transactions, so accuracy is essential.

Mistakes in TDS Amount or Payment Date

- Entering the wrong TDS amount or an incorrect payment date can result in discrepancies.

- It may also lead to penalties if the TDS amount appears to be unpaid or underpaid.

Incorrect Assessment Year (AY)

- The assessment year should correspond to the financial year in which the property transaction took place.

- Selecting the wrong AY may cause tax filing issues for the buyer and seller.

· How to Correct Mistakes in Form 26QB?

If you realize that you have made an error while filing Form 26QB, you must request a correction as soon as possible. Here’s how you can do it:

Visit the TRACES Portal

- TRACES (TDS Reconciliation Analysis and Correction Enabling System) is the official portal for TDS-related services.

- You need to log in to TRACES using your credentials as a buyer.

Request for Correction

- After logging in, navigate to the "Request for Correction" option under the TDS section.

- Choose the Form 26QB correction request and enter the necessary details.

Provide Corrected Information

- Update the incorrect details, such as PAN, property details, transaction value, or TDS amount.

- Ensure that the new information matches the original property sale agreement.

Approval from the Tax Department

- Some corrections require approval from the Assessing Officer (AO) before they are processed.

- In such cases, you may need to submit supporting documents to verify the requested changes.

Monitor Status and Download Updated Form

- Once the correction request is approved, you can download the updated Form 26QB from TRACES.

- Ensure that the seller also receives the correct version of the form to claim the tax credit properly.

· Why Is It Important to Correct Errors in Form 26QB?

Failing to correct mistakes in Form 26QB can lead to serious problems:

· Tax Credit Issues for the Seller – If incorrect PAN or TDS details are submitted, the seller may not receive the correct tax credit in Form 26AS, leading to tax liabilities.

· Penalties and Interest Charges – Any delay in correcting errors may result in penalties imposed by the Income Tax Department.

· Future Legal and Financial Complications – Errors in TDS reporting can create problems when selling the property in the future or during tax audits.

· Smooth Property Registration Process – Correcting mistakes ensures that there are no obstacles in the property registration and ownership transfer process.

13. Final Thoughts: Ensuring Smooth Property Transactions with TDS Compliance

· Tax Deducted at Source (TDS) on property transactions is an essential compliance measure in India aimed at ensuring transparency and curbing tax evasion in real estate dealings. When purchasing a property valued at ₹50 lakh or more, the buyer is required to deduct 1% of the total sale price as TDS before making the payment to the seller. This deducted amount must then be deposited with the Income Tax Department within 30 days from the end of the month in which the deduction was made.

· Certain exemptions apply to this rule. Agricultural land, irrespective of its value, is entirely exempt from TDS. Similarly, properties acquired through inheritance or as gifts do not require TDS deduction since no direct sale takes place. Additionally, when multiple buyers purchase a property and an individual’s share is valued below ₹50 lakh as per the sale agreement, TDS may not be applicable.

· The compliance process involves several key steps that buyers must carefully follow. After deducting TDS, the buyer must file Form 26QB online via the TRACES portal. Once the payment is processed, Form 16B must be generated and provided to the seller as proof of TDS deduction. Non-compliance can lead to penalties, including 1% monthly interest for late deduction, 1.5% monthly interest for delayed deposit, and a daily fine of ₹200 for late filing of Form 26QB.

· Special considerations apply to joint ownership and loan-financed property purchases. When multiple buyers are involved, each is responsible for deducting and depositing TDS separately. It’s important to note that banks do not deduct TDS on loan amounts—the responsibility lies solely with the buyer. In cases of excess TDS deduction, buyers can claim a refund through proper channels. If errors occur in Form 26QB, corrections can be made via the TRACES portal, but prompt action is necessary to prevent further complications.

· To ensure smooth compliance, buyers must verify the PAN details of all parties, maintain proper transaction documentation, and adhere to deadlines for filing necessary forms. The seller’s PAN is particularly crucial, as failure to provide it results in a significantly higher TDS rate of 20%. This structured framework promotes transparency in property transactions while ensuring tax obligations are met, contributing to a more regulated and accountable real estate market in India.

· While the TDS process may seem complex, it plays a vital role in financial accountability and reducing unaccounted transactions in the real estate sector. Understanding these regulations is crucial for both buyers and sellers to avoid penalties and ensure hassle-free property transactions.